Physician

Mortgage Solutions

Apply in Minutes. Get Prequalified Fast. Move in Sooner. We're Always on Call.

We'll be in touch in < 10 minutes

FDIC-Insured—Backed by the full faith and credit of the U.S. Government

We'll be in touch in < 10 minutes

Apply.

Start your homebuying pre-approval application. Our mortgage lenders will do the rest.

Shop.

Shop with confidence. Getting pre-approved shows sellers you mean business!

Close.

Finalize the process. Your new home is just a signature away.

Physician Bank has been helping doctors and healthcare professionals find the right mortgage for years. Our experienced lending team is here to guide you every step of the way with personal service and expert advice.

At Physician Bank, we don’t just process mortgages – we’re by your side with expert guidance and real people understand your profession, making homeownership faster, easier, and more personal.

We'll be in touch in < 10 minutes

up to 97% financing available on physician mortgage loans up to $806,500. Property use must be primary residence.

90-Day locks are subject to terms and conditions of the lock agreement.

Options for No Private Mortgage

Insurance Fees (PMI)

Maximum Debt to Income is 50%.

Single family dwellings, townhome, condo and 4-unit owner occupied purchases1.

Leniency towards student loan debt during decisioning. 0.5% of student loan balance used as monthly qualifying payment.

Additionally, qualified physicians can obtain mortgage financing up to $2,000,0001. Medical residents and practicing physicians may apply. Contact us today to learn more about physician mortgage loans!

We offer physician mortgage loans, personal and business loans, and private banking services for licensed physicians in all 50 U.S. states.

1 Subject to approval, up to 97% financing not available on loans over $806,500. Contact us to learn more.

"We are very pleased with the service that Matt Velline provided during our home buying process! He is very efficient and a great communicator, making the experience less stressful. We will recommend him to our friends and family and will be using him in any future endeavors."

Hannah M. - May 2025

"I feel so incredibly lucky to have been able to work with Nikki Rydberg for my physician home loan. She repeatedly went above and beyond the call of duty to help me. She not only was the one who discovered a long-standing error in my credit report that even I had somehow missed (my medical student loans were reported in duplicate!), but she helped correct that error for the sake of this loan, and additionally helped me figure out next steps to take for permanent dispute of this reporting error for the sake of my credit in general. She was available to me around the clock for any and all questions, and I truly could not have asked for a better partner in navigating this stressful time. @Heritage Bank and @Physician Bank, you are incredibly lucky to have Nikki on your staff – I do not have enough positive things to say about my experience working with her!"

Katie M. - October 2025

"A huge thank you to Julie for funding the loan in just nine days—especially after a previous lender couldn’t in 30. Her responsiveness, proactive approach, and efficiency made all the difference, ensuring a smooth appraisal process and quick funding.

Julie, your professionalism and outstanding performance were truly impressive. It was a pleasure working with you!"

Marilyn C. - September 2025

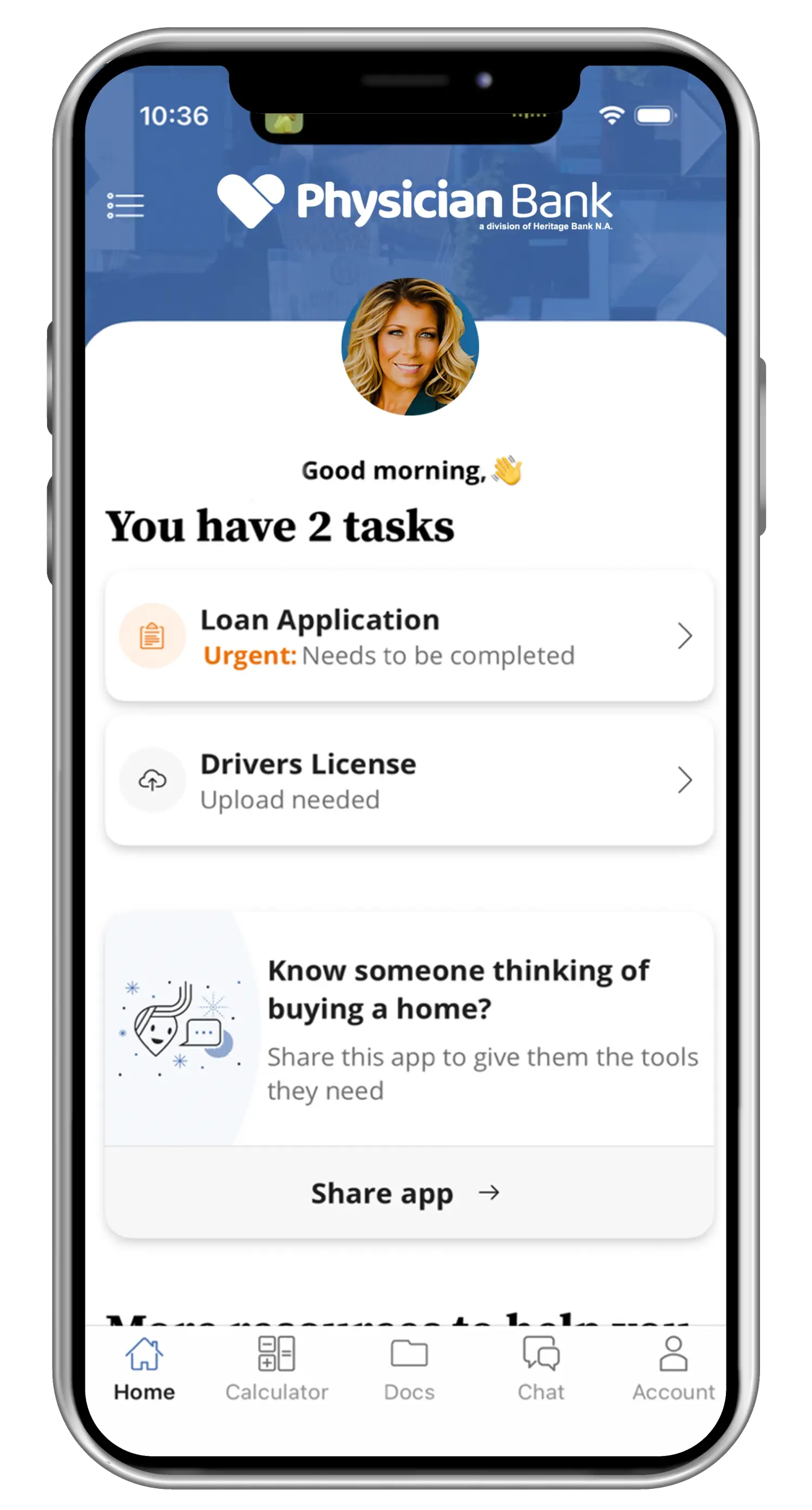

Applying for a mortgage can be stressful, but the MyLoan app from Physician Bank makes it simple, efficient and stress-free. Check out these great features:

Buying a home is a major milestone, but for physicians, the journey can be uniquely complex. Between long hours, high student loan debt, complex compensation contracts and delayed earning potential, navigating the mortgage process can feel overwhelming. That’s why understanding key terms like prequalification and pre-approval is essential, especially when exploring physician mortgage programs designed with doctors in mind.

The purpose of this article is to describe what a physician loan is and how it is used. It will also answer some of the top questions people have regarding these loans. In addition, we will investigate investment property issues, private mortgage insurance (PMI), credit scores, loan payments, buying a home, loan types and loan programs. If you are thinking about getting a doctor loan, buying a home, or refinancing your existing home to reduce your interest rate or decrease your monthly payments...

At our employee-owned bank, we value you as a partner and treat your business as if it were our own. Our dedicated team of lenders is just a phone call, text or email away, ensuring we are always there to support you.

Important Information

Procedures for Opening an Account Mandated by the USA PATRIOT ACT

To help the government fight the funding of terrorism and money laundering activities, the USA PATRIOT ACT, a Federal law, requires all financial institutions to obtain, and record information that identifies each person who opens an account.

What this means for you:

When you open an account, we will ask you for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.